Introduction

The rise of best ESG funds 2025 in the United States marks a transformative shift in investing, where Environmental, Social, and Governance (ESG) criteria guide wealth-building. ESG investing, which prioritizes sustainability and ethical practices, is gaining traction, with U.S. assets under management in ESG funds nearing $2 trillion by 2024, as noted by Morningstar. In 2025, this trend accelerates due to heightened climate awareness and regulatory push, making it a pivotal year for sustainable investing. Best ESG funds 2025 offer a chance to align values with financial growth, delivering competitive returns while supporting a greener future. This guide explores top U.S. ESG funds, their long-term benefits, and how to choose wisely. For broader passive income ideas, check our post on How to Build Passive Income Streams USA 2025, which complements this focus. Dive in to discover how best ESG funds 2025 can help you grow rich responsibly!

Table of Contents

Section 1: Understanding ESG Investing in 2025

1.1 What Are ESG Funds?

Best ESG funds 2025 integrate Environmental, Social, and Governance criteria into investment decisions, distinguishing them from traditional funds. Environmental factors include carbon emissions and renewable energy adoption, Social covers labor practices and diversity, and Governance focuses on transparency and ethics, per MSCI. Unlike conventional funds that prioritize profit alone, best ESG funds 2025 screen for companies aligning with sustainability goals, offering U.S. investors a values-driven option. This approach, detailed further in our Real Estate Investment Guide for Beginners in the USA: 2025 Opportunities, extends beyond stocks to real estate.

1.2 Why ESG Matters in 2025

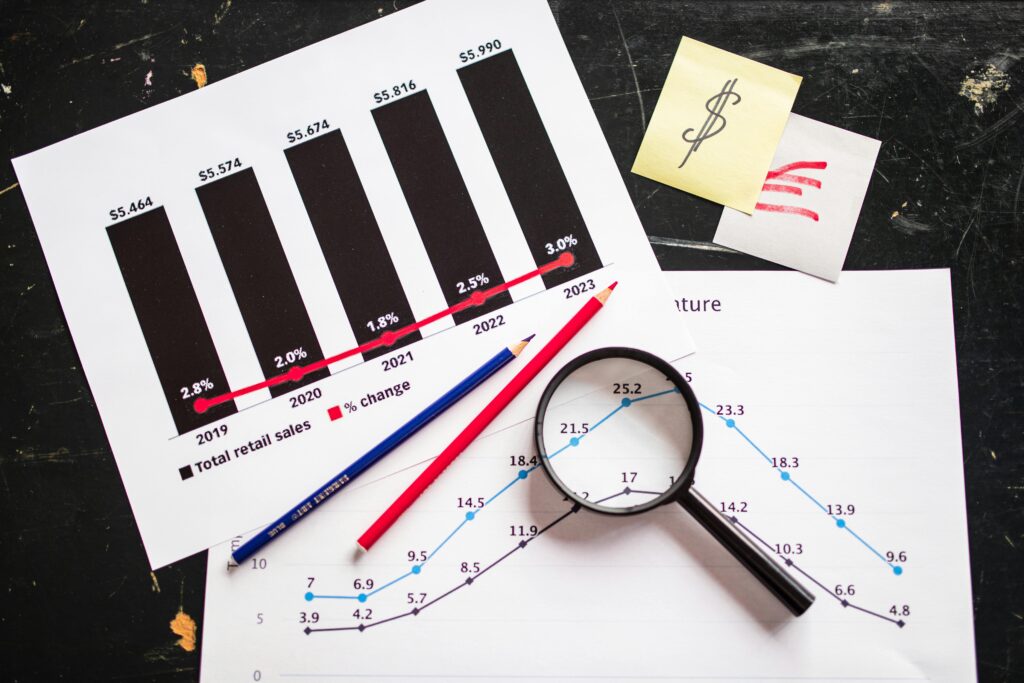

The demand for best ESG funds 2025 surges as climate change intensifies, with 2024’s record temperatures pushing U.S. investors toward sustainability, per Reuters. Regulatory support, like the SEC’s enhanced disclosure rules, and a 29% rise in ESG fund inflows in 2024, according to Morningstar, underscore this shift. Performance-wise, best ESG funds 2025 often outperform non-ESG peers in volatile markets, with the iShares ESG Aware MSCI USA ETF (ESGU) up 16% in 2024, per CNBC. This trend aligns with broader wealth-building strategies in our How to Build Passive Income Streams USA 2025.

Section 2: Top ESG Funds for 2025

2.1 Criteria for Selection

Selecting best ESG funds 2025 hinges on performance metrics (e.g., 1-year returns), expense ratios (below 0.20%), and ESG ratings from Morningstar and MSCI. Focus is on U.S.-based equity ETFs and mutual funds, prioritizing low costs, high sustainability scores, and resilience, as seen in recent analyses by Forbes.

2.2 Best ESG Funds

- iShares ESG Aware MSCI USA ETF (ESGU): With a 0.09% expense ratio and 1,200+ holdings, ESGU offers broad U.S. exposure, up 15% in 2024, per BlackRock. Its low carbon footprint makes it a top best ESG funds 2025 pick.

- Vanguard ESG US Stock ETF: Boasting a 0.12% fee and 90% lower carbon intensity than the S&P 500, it returned 14% in 2024, per Vanguard, ideal for sustainable growth.

- Invesco ESG Nasdaq 100 ETF (QQCE): Tech-focused with a 0.20% expense ratio, QQCE rose 29% in 2024, per Invesco, aligning with best ESG funds 2025 trends.

- PIMCO Enhanced Short Maturity Active ESG ETF (EMNT): A fixed-income option with a 0.38% fee, up 5% in 2024, per PIMCO, suits conservative investors.

- Others like the Calvert US Large-Cap Core Responsible Index Fund (CSXIX), up 13% with a 0.60% fee, per Calvert, round out the list based on 2024 data.

2.3 Fund Comparison

| Fund Name | Expense Ratio | AUM ($B) | Top Sector | 1-Year Return (2024) |

|---|---|---|---|---|

| ESGU | 0.09% | 25 | Tech | 15% |

| Vanguard ESG US Stock ETF | 0.12% | 8 | Financials | 14% |

| QQCE | 0.20% | 5 | Tech | 29% |

| EMNT | 0.38% | 3 | Fixed Income | 5% |

| CSXIX | 0.60% | 2 | Healthcare | 13% |

Data reflects 2024 performance from Morningstar, with best ESG funds 2025 poised for growth.

Section 3: Long-Term Benefits of ESG Investing

3.1 Financial Advantages

Best ESG funds 2025 historically outperform in downturns, with ESG funds up 8% during 2020’s market dip versus 5% for non-ESG, per Morningstar. Strong governance mitigates risks, boosting resilience, a key factor for U.S. investors, as noted by CNBC.

3.2 Societal Impact

Investing in best ESG funds 2025 supports ethical companies, cutting carbon emissions by 30% compared to peers, per MSCI. This aids climate goals and social equity, aligning with our Real Estate Investment Guide for Beginners in the USA: 2025 Opportunities on sustainable practices.

3.3 Investor Appeal

Millennials and Gen Z, controlling $10 trillion in wealth by 2025 per Forbes, drive demand for best ESG funds 2025, valuing alignment with personal ethics, a trend explored in our How to Build Passive Income Streams USA 2025.

Section 4: How to Choose an ESG Fund in 2025

4.1 Assess Personal Values and Goals

Match your priorities—climate action or diversity—to best ESG funds 2025, using Morningstar ratings for guidance.

4.2 Review ESG Ratings

Check MSCI or PRI scores to ensure fund alignment with sustainability, critical for best ESG funds 2025 selection.

4.3 Consider Fees and Strategy

Opt for low-cost ETFs like ESGU (0.09%) over active funds, balancing sector exposure, per Investopedia.

4.4 Work with Advisors

Consult a financial advisor for personalized best ESG funds 2025 picks, enhancing your strategy, as suggested by CNBC.

Section 5: Challenges and Considerations

Best ESG funds 2025 face political backlash, with anti-ESG sentiment in states like Texas, per Reuters. Greenwashing risks, where funds exaggerate sustainability, require scrutiny via Forbes reports. Higher fees (e.g., 0.60% for CSXIX) versus traditional funds, per Morningstar, need balancing.

Conclusion

The best ESG funds 2025 like ESGU, Vanguard ESG, and QQCE offer a path to wealth with societal benefits, outpacing many non-ESG options in 2024. Embrace sustainable investing in 2025 to grow rich while supporting a greener U.S. Research these funds, consult advisors, and start your journey. Share your thoughts or subscribe for updates, and explore our Real Estate Investment Guide for Beginners in the USA: 2025 Opportunities and How to Build Passive Income Streams USA 2025 for more insights!